- REFInd is a boot manager for UEFI computer that will allow you to choose between Windows, Linux and Mac OS X, and other operating systems when you boot your computer, it can auto-detect your installed operating systems and presents a pretty GUI menu these operating systems. REFInd is one of the most popular multi-boot managers on the market.

- MacOS Speciality level out of ten: 1. Jul 21, 2021 8:12 AM in response to arpan2502 In response to arpan2502.

- Basically somehow Logic Pro has been bought twice, because it let me buy an app that I already owned (previously bought via the Pro education bundle but not yet redeemed). I tried explaining to apple that they took £199 for an app that I already own, they said to wait for the refund process to be reviewed and today they said they can’t.

- REFInd is a boot manager that will allow you to choose between Mac OS X, Linux, Windows, and other operating systems when you boot your computer. Installing rEFInd makes the dual-boot process easier. (Some older how-to’s will instruct you to use rEFIt, but it’s no longer maintained. REFInd is a currently maintained boot manager based on rEFIt.).

Hardware is mid-2011 Mac Mini. Partitioned Mac, installed Refind, then Leap 15.2 OS. Nothing after restart from Leap install. Used option key cold start to get back into Mac OS. Reinstalled Refind, restarted and was able to choose Leap from Refind menu. After doing usual post-install config stuff in Leap I rebooted and once again got blank screen. Same option key cold start got me back to Mac OS, same reinstall of Refind and restart got me menu again.

While in Leap I visited Sourceforge rEFInd page and downloaded the RPM file, then installed through YaST. This did not change anything. I eventually looked at Leap YaST Boot Loader Settings and unchecked 'Enable Secure Boot Support'. This gave me a better result, although not completely what I expected.

My current status is as follows: If I reboot Leap I do not receive the Refind menu but see the normal Leap 15.2 startup and OS load. The only way I can load Mac High Sierra is by using the option key during cold start or restart and choosing Mac OS. If I reboot from the Mac OS I get the normal Leap 15.2 startup and OS load.

My expectation and goal with this dual-boot system is to see the Refind menu after restarting either of the installed operating systems. Fairly sure I'm missing something here, with the inclination that I need to do something further with the Refind installation on the Leap side. I thought the Boot Loader drop down list in the YaST Boot Loader Settings might have an entry for Refind but it doesn't, and I'm not sure what 'Not Managed' is for. I didn't see any other settings in here that seemed relevant. System is usable at this point so that's good.

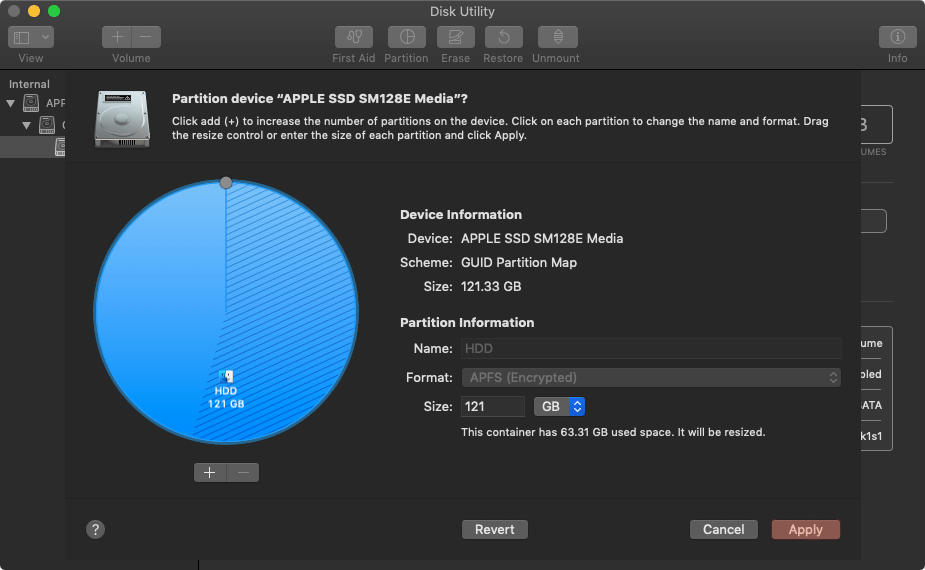

The -ownhfs device-fileoption is a macOS-specific option that causes rEFInd to install itself to an HFS+ volume that you specify by device filename, as in./refind-install -ownhfs /dev/disk2s4.

Across the US, many families are still waiting to get their federal income tax refunds. The deposits are taking longer than usual this year. There are a few reasons for this: Stimulus checks, child tax credit payments and the pandemic. If you still haven't received your money, you're not alone. As of June, there were nearly 35 million unprocessed returns reported by the Taxpayer Advocate Service, including those returns that are still being reviewed.

By the numbers, there were over 2.2 million stimulus checks sent, tax breaks and $15 billion disbursed in child tax credit checks. Even though this money may help some families, a tax refund would be a big relief. But for those that are still waiting, there's a bit of good news. The IRS just issued another round of refunds for overpayment of taxes on 2020 unemployment compensation.

So where's your money? We'll explain how to track your federal tax refund with the Where's My Refund tool and check your unemployment refund status with your tax transcript. It's also a good idea to see if you qualify for child tax credit payments for some extra money (The next payment is Aug. 13.) If you're curious about the future of stimulus payments or the latest infrastructure deal, we can tell you about that, too. This story is updated on a regular basis.

© Angela Lang/CNETWhy are federal income tax refunds delayed this year?

Because of the pandemic, the IRS ran at restricted capacity in 2020, which put a strain on its ability to process tax returns and created a backlog. The combination of the shutdown, three rounds of stimulus payments, challenges with paper-filed returns and the tasks related to implementing new tax laws and credits created a 'perfect storm,' according to a National Taxpayer Advocate review of the 2021 filing season to Congress.

The IRS is open again and currently processing mail, tax returns, payments, refunds and correspondence, but limited resources continue to cause delays. The IRS said it's also taking more time for 2020 tax returns that need review, such as determining recovery rebate credit amounts for the first and second stimulus checks -- or figuring out earned income tax credit and additional child tax credit amounts.

Here's a list of reasons your income tax refund might be delayed:

- Your tax return has errors.

- It's incomplete.

- Your refund is suspected of identity theft or fraud.

- You filed for the earned income tax credit or additional child tax credit.

- Your return needs further review.

- Your return includes Form 8379 (PDF), injured spouse allocation -- this could take up to 14 weeks to process.

If the delay is due to a necessary tax correction made to a recovery rebate credit, earned income tax or additional child tax credit claimed on your return, the IRS will send you an explanation. If there's a problem that needs to be fixed, the IRS will first try to proceed without contacting you. However, if it needs any more information, it will write you a letter.

How can I track my income tax money online?

To check the status of your 2020 income tax refund using the IRS tracker tools, you'll need to give some information: your Social Security number or Individual Taxpayer Identification Number, your filing status -- single, married or head of household -- and your refund amount in whole dollars, which you can find on your tax return. Also, make sure it's been at least 24 hours (or up to four weeks if you mailed your return) before you start tracking your refund.

Using the IRS tool Where's My Refund, go to the Get Refund Status page, enter your SSN or ITIN, your filing status and your exact refund amount, then press Submit. If you entered your information correctly, you'll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you'll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status -- it's available in English and Spanish. You'll be able to see if your return has been received, approved and sent. In order to login, you'll need some information -- your Social Security number, your filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don't see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you'll receive a personalized date to expect your money.

Where's My Refund has information on the most recent tax refund that the IRS has on file within the past two years, so if you're looking for return information from previous years you'll need to contact the IRS for further help.

When should I expect my check to show up?

The IRS usually issues tax refunds within three weeks, but some taxpayers have been waiting months to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be pretty lengthy. If there is an issue holding up your return, the resolution 'depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,' according to its website.

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive.

What do these IRS messages mean for my refund?

Both IRS tools (online and mobile app) will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you're owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox. (Here's how to change the address on file if you've moved.)

How can I get an update on my unemployment refund check?

If you think there's a delay in adjusting your tax return and getting a refund for the 2020 unemployment compensation, it might still be too soon to worry. The American Rescue Plan Act of 2021, implemented in March, excluded up to $10,200 in 2020 unemployment compensation from taxable income calculations for individuals and married couples who earned less than $150,000. That means taxpayers who treated their unemployment compensation as income are eligible for a tax break and could get a hefty sum of money back.

In late May, the IRS began automatically correcting returns for those who overpaid taxes on those benefits, and the process is supposed to continue throughout the summer for the 13 million taxpayers who might be eligible. According to the IRS, the first batch for more than 2.8 million refunds went out in early June, and another batch of nearly 4 million refunds started to go out in mid-July. That means that millions more will still have to wait a bit longer.

However, it's not easy to track the status of that refund using the online tools above. To find out when the IRS processed your refund and for how much, we recommend locating your tax transcript by logging in to your account and viewing the transactions listed. We explain how to do that step by step and what else you need to know here.

IRS TREAS 310 is on my bank statement. What does it mean?

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment (direct deposit). This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see TAX REF in the description field for a refund.

If you received IRS TREAS 310 combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Macos Finder Ftp

Should I contact the IRS about the status of my money?

The IRS received 167 million calls this tax season, which is four times the number of calls in 2019. And based on the recent report, only seven percent of calls reached a telephone agent for help. While you could try calling the IRS to check your status, the agency's live phone assistance is extremely limited right now because the IRS says it's working hard to get through the backlog. You shouldn't file a second tax return or contact the IRS about the status of your return.

Even though the chances of getting live assistance are slim, the IRS says you should only call if it's been 21 days or more since you filed your taxes online, or if the Where's My Refund tool tells you to contact the IRS. Here's the number to call: 800-829-1040.

How will my tax refund be delivered?

Macos Find App

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse's name or a joint account. If that's not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS' next best way to refund your money quickly.

Refind Macos Big Sur

It's also important to note that for refunds like the child tax credit, direct deposit isn't always automatic. Some are now claiming that like the stimulus checks, the first payments for the child tax credit are being mailed. Just in case, parents should sign in to the IRS portal to check that it has their correct banking information. If not, parents can add it for the next payment in August.

Macos Refind

For more information about your money, here's the latest on federal unemployment benefits and how the child tax credit could impact your taxes in 2022.